Highlights

WhatsApp is launching a cash transfer service within the messaging app across India. Currently, WhatsApp is working with ICICI Bank to make this a reality for users. This, in all likelihood, is going to be a payment-based service – which will enable money transfer from a sender to a receiver. It has been learned that WhatsApp will soon announce a pilot for the same within India – giving users the option to send and receive money through the app. In one of its blog posts, WhatsApp stated that “We’re not confirming this feature just yet, but stay tuned! We’re always exploring ways to help people communicate better with each other. In India especially, where cash plays an important role in daily life, we’re always looking for ways to help you stay connected to family, friends, and businesses.”The company also stated that it will be making the feature available to users in phases. It is now working with the Indian government to make its payments service compliant with local regulations. WhatsApp is now frantically working towards making this service available to all its users. The service is expected to be rolled out before the end of this year; however, there is no specific timeline defined for the service as of now. It is interesting to note that WhatsApp is not the only instant messaging service looking to launch a banking service.

Who will be the Partners of WhatsApp Payment Service?

WhatsApp will start this service with ICICI Bank as a partner, another Indian bank is waiting to come on board as the second partner. Stay tuned! We’re always exploring ways to help people communicate better with each other. In India especially, where cash plays an important role in daily life, we’re always looking for ways to help you stay connected to family, friends, and businesses. The company also stated that it will be making the feature available to users in phases. It is now working with the Indian government to make its payments service compliant with local regulations. WhatsApp is now frantically working towards making this service available to all its users. The service is expected to be rolled out before the end of this year; however, there is no specific timeline defined for the service as of now. It is interesting to note that WhatsApp is not the first tech giant to launch a UPI-based service. Earlier this month, Google Tez, a UPI-based digital payment service from tech giant Google, was launched in India.

Multi-Bank support

WhatsApp can support multiple banks only if the NPCI allows the messaging app to support multiple banks. As of now, it’s not clear if this functionality will be enabled, because the NPCI does not work for companies that don’t offer their own UPI-enabled apps. To make sure you can use WhatsApp, make sure you ask your bank if they work with the NPCI. Write a blog post about the launch of the WhatsApp UPI service in India.WhatsApp has now launched its service called WhatsApp Payments in India and is currently working towards making it available to its users. The company told the media that it is working with the Indian government to make its payments service compliant with local regulations and is now working towards making this service available to all its’ users. And we can understand why this is a big market that will help the company add a new revenue stream. So how can you get WhatsApp payments in India if your bank does not support this service? The only way you can use WhatsApp payments is by linking your bank account to the service.

USPs of WhatsApp Payment Service

WhatsApp Messenger is a cross-platform mobile application that has been recently come up with a new idea of adding a Payment feature. WhatsApp will have direct competition with other giants – Paytm and PayU. WhatsApp is planning to launch a Payment service globally as soon as possible. This is not the first time WhatsApp is trying to lure us with its new features. They had their glimpse of success when the Chat 2.0 update with free video-calling came out. The long-awaited application, WhatsApp Payments has finally launched in India today with the company saying that it is working with the Indian government to make this service compliant with local regulations. This is an exciting time for WhatsApp, an opportunity to expand their revenue stream by tapping into the Indian market.

Criteria to use WhatsApp Payment service

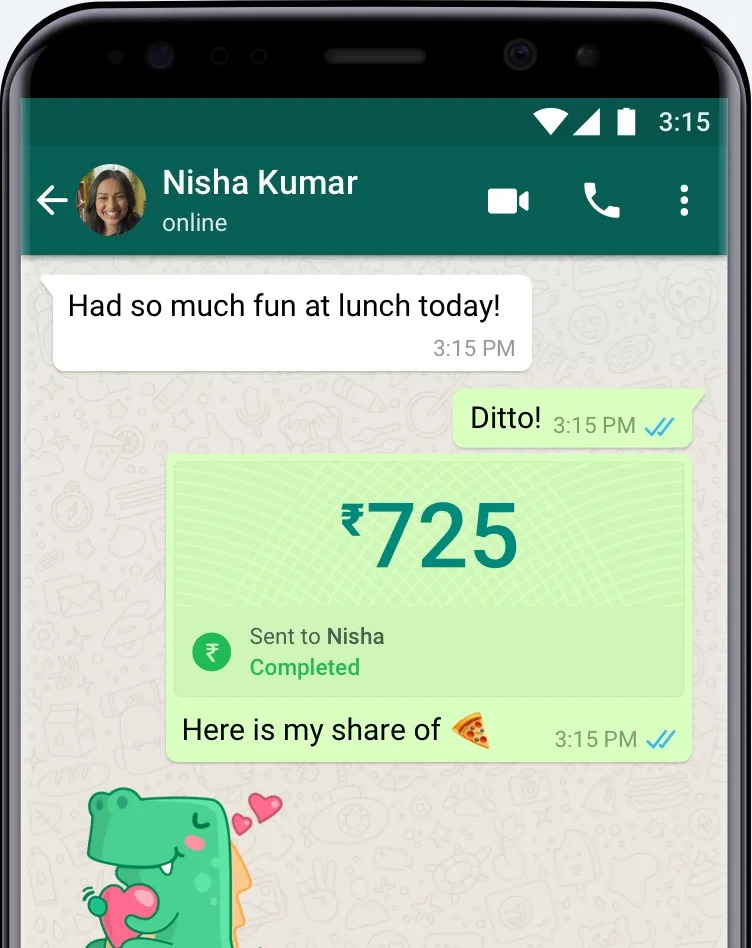

You can send or receive money to your contacts in the app. The recipient will get a notification from WhatsApp asking them if they want to accept the money. They will receive the money in their Wallet. If the recipient doesn’t have a Wallet, the transaction will be transferred to their bank account. The sender can decide a custom time when they want to receive a notification. If the sender sets a time of 15 minutes, the recipient will have 15 minutes to accept the money. The long-awaited application, WhatsApp Payments has finally launched in India with the company saying that it is working with the Indian government to make this service compliant with local regulations. This is an exciting time for WhatsApp and we can expect many more features to be rolled out in the coming months.

Conclusions of WhatsApp Payment Service

The payment service WhatsApp is a platform that takes a great deal of friction out of the whole process of paying for goods and services. One of the biggest obstacles to a seamless payment process is the willingness of the person being paid to share their bank or credit card information with the person they are buying from. With WhatsApp, you don’t have to share your information with the person you are paying, so it can be a very private and secure process.

There are many benefits to using WhatsApp. One of the most obvious benefits is that it is a very quick and easy payment option. Proof of purchase is verified without requiring a receipt or a signature, and delivery of goods or services can be tracked in a way that has never been possible before